Autumn Budget 2025: The Landlord Tax and What it Means for You

The 2025 Autumn Budget announced today, 26th November, introduced a 2‑percentage‑point rise on tax rates applying to property income and savings/dividend income.

Starting from April 2027, landlords will pay higher tax on rental profits, no longer at the existing rates of 20%, 40% or 45%, but at 22%, 42% and 47% respectively, depending on your income band.

Andy Brown, Avocado Property Lettings Director, notes:

“The 2% rise on property income tax is another squeeze, but it’s not the knockout blow some people will claim. Accidental landlords, the ones who didn’t plan to be in the sector, may notice the change more because their margins are usually tighter. New landlords will see it as another factor to weigh up but it shouldn’t put them off entirely.”

Importantly, this tax rise doesn’t come into effect until April 2027, giving landlords time to plan and adjust. But the message is clear: rental income is now being taxed closer to employment earnings, eroding what used to be a clear fiscal advantage for property investors.

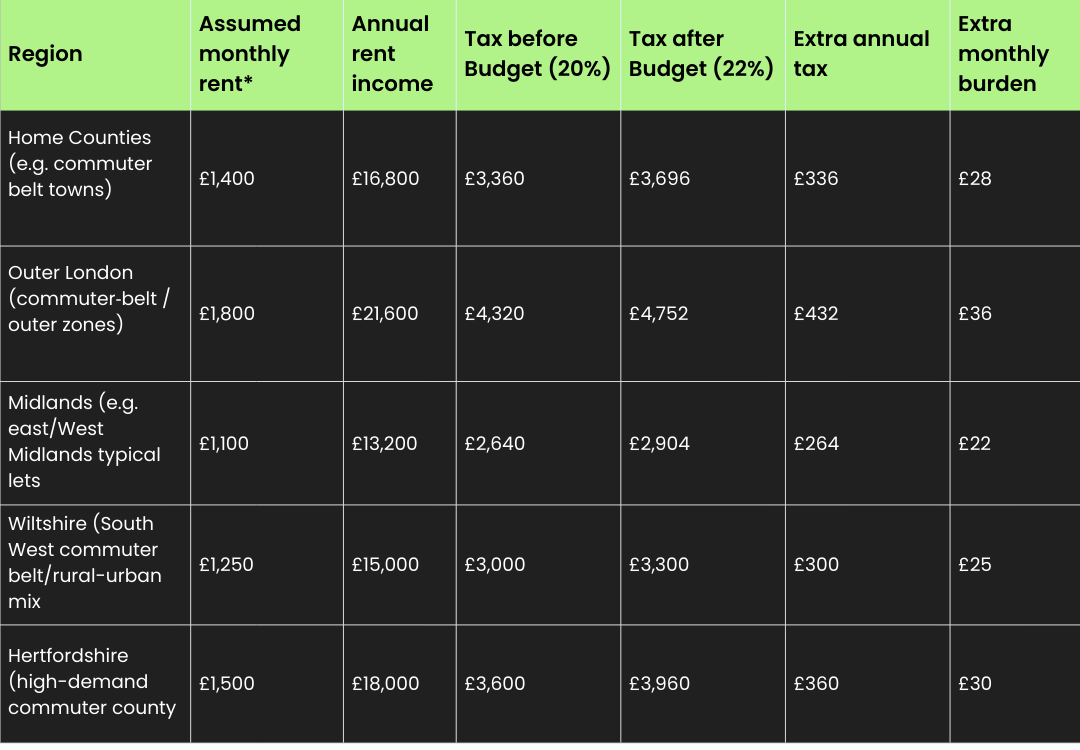

Regional Impact: What It Means in Real Money

Before we get into the table, here’s a practical scenario from Andy that brings the numbers to life:

“Take an average rental at £2,000 a month. If a landlord clears around £400 profit after costs, the current 20% basic-rate tax means £80 goes to HMRC. Under the new 22% rate, that becomes £88. Higher-rate taxpayers will see the same pattern as they move from 40% to 42%. It’s noticeable, but it’s not enough to derail renting out a property in my opinion.”

This type of micro-level example helps contextualise the broader regional impacts, which we explore below.

The Compounding Challenge: Tax + Regulation = Tighter Margins

“Landlords have faced higher costs for a number of years,” Andy explains, “and this will be another reduction in post-tax income. However, rents have risen by around 25% over the last five years, and that growth has supported landlords’ income even as running costs have increased.”

When considered alongside the Renters Rights Act, which is increasing legal and maintenance obligations, this new tax increase forms a compounding challenge. Income is squeezed just as compliance costs rise.

“In a market where demand massively outweighs supply, added costs don’t just sit with landlords,” Andy notes. “They eventually nudge rents upwards. Even the OBR recognises this in its own commentary.”

This underlines a potential unintended consequence of these policies: reduced supply and further pressure on tenant affordability.

Conclusion with Forward-Looking Perspective

“But for anyone thinking of staying in or entering the market, the opportunity is still there,” Andy concludes. “If you run your property efficiently, keep up with maintenance and price it correctly, the rental sector remains a strong, stable long-term investment, especially with the level of demand we’re seeing.”

This final note strikes the perfect balance between realism and optimism, reinforcing the blog’s core message: with the right model, landlords can still thrive.

Revised Conclusion

Yes, the numbers make it clear: between the new landlord tax and obligations under the Renters' Rights Act, the rental landscape is getting tighter. But as Andy puts it, this isn’t a knockout blow. The fundamentals remain strong high demand, short supply, and opportunities for well-run rentals to outperform.

At avocado property, we’re here to help you approach it the right way. Whether you're refining your portfolio strategy or just need to decode what these changes mean for your income, we’re ready to partner with you.

Let’s optimise your rental returns together.