Thinking of upsizing, buying your first home or investing in the UK property market? You’ve probably wondered if you can add estate agent fees to your mortgage. At Avocado Property, we hear this a lot so here’s the clear answer

When upsizing within the UK property market buying your first home or investing as a landlord, your head’s likely buzzing with financial questions. One we get a lot at avocado property is:

“Can I bundle the estate agent fee into my mortgage?”

Spoiler: No, you can’t add estate agent fees to your mortgage, they're selling costs and lenders simply don’t include them as loanable items. But don’t worry, if you read on, we break down what can be added, what can’t, and share savvy strategies to keep costs down.

Who Pays Estate Agent Fees?

UK estate agent fees are always paid by the seller, not the buyer. That means those 1 - 3.5% (plus 20% VAT) of the sale price are covered by whoever’s selling the property, you, if you're upsizing and deducted from your sale proceeds at completion.

Example: Selling your Swindon semi for £350,000 with a 1.5% + VAT fee (~£6,300) means it comes out of what you receive but doesn’t affect your mortgage for the next place.

So, Why Lenders Don’t Let You Add Estate Agent Fees to Your Mortgage

This one catches a lot of people out, especially when you're juggling dozens of moving costs and wondering what you can and can’t roll into the big loan. But here's the key rule:

Mortgages are based on the property’s value, not your moving costs.

When a lender (like NatWest, Halifax, or Santander) gives you a mortgage, they’re effectively investing in your property. The amount they’ll lend is calculated as a percentage of your home’s value, usually up to 95% for first-time buyers, or 60 - 85% for landlords and upsizers. This percentage is called the Loan to Value (LTV).

Now, let’s be clear (and we’re sorry to deliver this news): moving house in the UK is expensive. Between estate agent fees, legal costs, surveys and removals, it adds up fast. So, it makes sense to ask if you can just pop all those extras on the mortgage tab.

But, sadly, the lender’s not footing your moving bill, they’re protecting their asset. That means they’re only willing to cover costs that directly relate to assessing, securing, or managing the property’s value or risk.

✅ What gets included in a mortgage (sometimes):

Depending on the lender, you may have the option to do any of the following:

- Valuation fees: They need to check the property is worth what you’re paying.

- Arrangement or product fees: These relate to the loan itself.

- Mortgage account fees: To set up and manage the account.

- Higher lending charges (HLC): If you're borrowing at a higher LTV, this insures them against risk.

As these are lender centric. They benefit them, so they’ll let you bundle these into your loan (with interest, of course).

❌ What doesn't get included:

- Estate agent fees

- Solicitor or conveyancer costs

- Surveyor fees (when paid by the buyer)

- Removals, storage, or packing

- Stamp duty (in most cases)

Why? Because these are your personal costs as a buyer or seller, not expenses that protect the lender’s interest in the property. Estate agent fees, in particular, are about selling your old place, not buying the new one. They’re considered part of the selling process and as such, must come from your proceeds, or your pocket.

Example time:

You’re selling your Bracknell based 3 bed semi-detached for £500,000 and buying a family home in Burghfield for £650,000.

- Your estate agent charges 1.2% + VAT (£7,200)

- Your solicitor charges £1,200

- Your removals cost £1,000

- Your lender charges a £995 arrangement fee

Of all those fees, only the £995 can potentially be added to your mortgage. The rest? You'll need to have those funds ready separately, through your sale profits, savings, or a well-planned budget.

💡 Is It Smart to Add Fees to Your Mortgage?

Like most things in property, the answer to whether you should add fees to your mortgage is: it depends. What you’re really doing is weighing convenience against cost and that’s a decision that depends on your financial situation, future plans and how tight your budget is during the move.

Let’s break it down.

🔹 The Pros: When Rolling in Fees Can Help

- One Monthly Repayment

- Adding arrangement or product fees to your mortgage can make the whole process feel a lot simpler. It’s just one monthly outgoing, with no need to scrape together £1,000+ before your mortgage completes.

- Improved Cash Flow at a Crucial Time

- Buying a home involves lots of upfront costs especially if you’re upsizing and trying to juggle deposits, legal fees, removal costs and possibly renovation plans. If paying everything at once will stretch your budget too far, adding lender fees to your mortgage can provide valuable breathing room.

- Helps First-Time Buyers and Upsizers

- If you’re putting down a big chunk for your deposit or relying on equity from your sale, having the flexibility to defer some fees can reduce the strain during the move itself.

⚠️ The Cons: What You Might Be Giving Up

- It’s Not Free Money - You’ll Pay Interest

- Any fees added to your mortgage will accrue interest for the full mortgage term (often 25 to 35 years). What looks like a £995 arrangement fee today could cost £1,400+ over time depending on your interest rate.

- Increased Loan to Value (LTV)

- Adding fees increases your total loan size. That means your LTV ratio, the percentage of the property’s value you're borrowing, goes up. And that can be a problem… If your LTV tips over into a higher bracket (say from 85% to 90%), it could mean less favourable mortgage rates, costing you more over the life of the loan.

- Higher Monthly Payments and Debt Load

- A larger mortgage means bigger monthly repayments. For upsizers in areas like Wokingham or Guildford, where average home prices are already higher than the national average, every added pound counts. You're not just borrowing more; you’re borrowing it for longer and paying interest on it throughout.

UK Market Context – An Expert’s Perspective

Whatever your situation, from upsizing in Berkshire, entering Solihull’s market or buying an investment property in Stevenage; mortgage landscapes matter.

Tom Ashton, Founder of Mortgage Tribe says it clearly:

“With the stabilisation in interest rates in mid 2025, now is an opportune time for buyers to secure favourable mortgage deals. It's essential for prospective homeowners to consult with a mortgage adviser to understand if there are any changes to the market that could impact them. This ensures they find the best options available for their personal situation. Finding the right mortgage product (especially fee vs rate) is critical to overall costs and long-term affordability!”

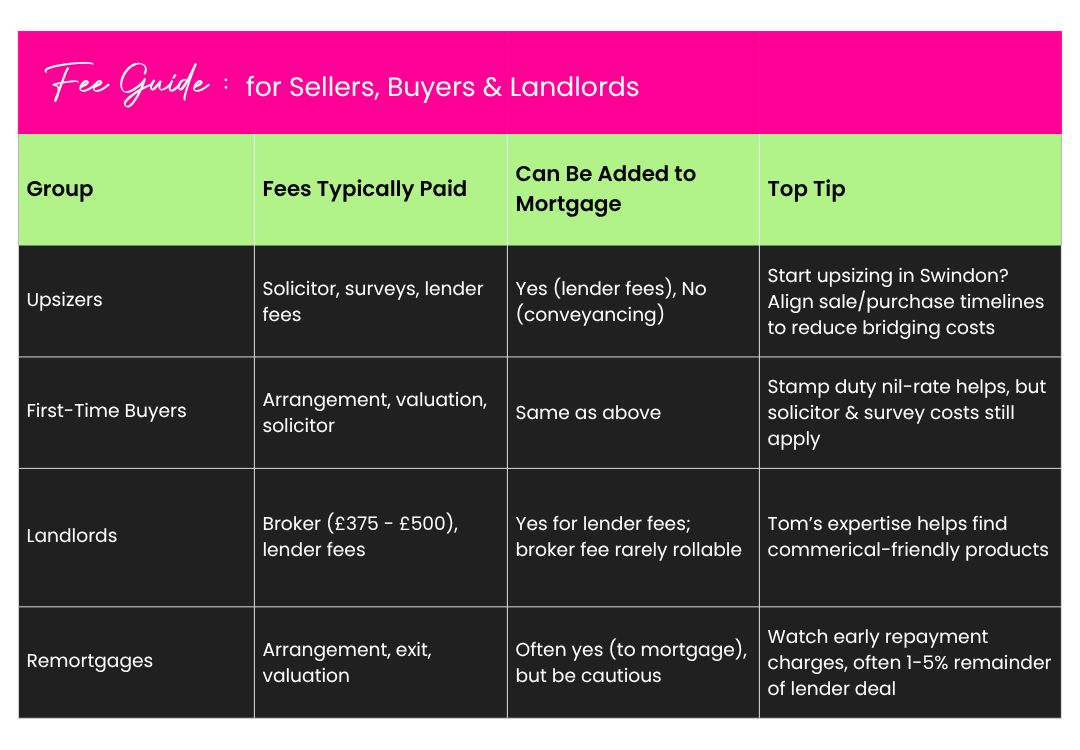

Quick Fee Guide for Sellers, Buyers & Landlords

Finding your way through the maze of moving costs can feel like trying to assemble flat-pack furniture without the instructions, especially when you're upsizing, buying your first home, or managing a rental portfolio. To make things simpler, we’ve pulled together a quick, no-nonsense fee guide. Whether you’re selling a home in Binfield, buying in Shinfield, or investing in Calcot, here’s what you’ll likely pay, what you can roll into your mortgage, and where to keep an eye on the fine print

How Avocado Property Helps You Navigate

At avocado property, we’re not just listing homes. We go end-to-end with you:

- Strategic Marketing: Tailored to your timing, launch your sale when its best for your upsizing move.

- Smart Timing: Help align your sale/purchase so that funds flow smoothly to reduce the amount of awkward overlap from old home to new.

- Mortgage & Broker Partnership: We partner with Mortgage Tribe team to ensure:

- Best loan product for your path (upsizing, investing, first-time).

- Full understanding of fees and what can be mortgaged.

- Clear transparency - no lurking fees, no jargon and most importantly, no surprises.

Final Thoughts

- ❌ You can’t add estate agent fees to your mortgage - that’s why avocado ensures sellers get value for money with their estate agency fees and are and clear about the costs.

- ✔️ You can add lender-arranged fees with lenders but remember you’ll pay interest on them.

- 💡 You should work with mortgage brokers like Mortgage Tribe to compare fee vs rate and ensure you're on the best plan.

- 📍 Local context matters: From Swindon to Bracknell, house prices are fluid; plan your sale & mortgage timing with intention.

✅ Your Move – Next Steps

- Get a tailored comparison of mortgage products, fee vs rate, based on your deposit and loan size.

- Ask avocado to matchmake deal and sale timings, so you're not juggling big bills at once.

- Budget upfront for solicitor, survey, EPC, removal and storage.

- Chat with Tom Ashton or a Mortgage Tribe adviser for current market intelligence.

👉 Ready to buy, upsize or invest? Let's get started!

Let us know if you'd like market-specific breakdowns for Swindon, Bath, or even landlord-focused products in Bristol!

If you’d like a free consultation combining avocado property’s sale strategy with

Mortgage Tribe’s lending expertise, just ask. Let's make your move less stressful, structured, and seriously smart.