🚨 Stamp Duty May Be on the Way Out: What It Means for UK Home Buyers

For some buyers, it could mean lower upfront costs. For sellers of higher-value properties, it could mean a new tax bill.

Big news could be coming for anyone thinking of buying or selling a home in the UK. The government is looking into a potential shake-up of stamp duty, possibly replacing it altogether with a new type of property tax. But what does that really mean for you?

Let’s break it all down. No jargon. No political waffle. Just the facts, in plain English with a little help from avocado property.

🧾 First, What Is Stamp Duty?

Stamp Duty Land Tax (SDLT) is a tax you pay when you buy property or land in England or Northern Ireland (Wales and Scotland have different systems). It’s paid by the buyer of the home, not the seller, and the amount depends on the price of the property.

Here’s a quick look at how it currently works (as of April 2025):

Standard rates:

• Up to £125,000 – No stamp duty

• £125,001 to £250,000 – 2% on the portion above £125,000

• £250,001 to £925,000 – 5% on the portion above £250,000

• £925,001 to £1.5 million – 10% on the portion above £925,000

• Over £1.5 million – 12% on the portion above that

👉 First-time buyers get a special discount:

• 0% on the first £300,000

• 5% on the portion between £300,001 and £500,000

• If the property is over £500,000, standard rates apply to the full amount

It can be a significant cost for buyers. For example, buying a £600,000 home means you’d be paying £20,000 in stamp duty under today’s rules.

🕰 A Little Stamp Duty History

Stamp duty has been around for centuries, it originally came in back in 1694 to help fund wars. Yes, really. But in the context of property, it’s been a staple since 1958, and the modern version (SDLT) was introduced in 2003.

Over the years, it’s gone through lots of changes, different bands, reliefs for first-time buyers, and temporary cuts (like during COVID to help the market recover).

🚧 Why Change It Now?

Here’s where things get interesting…

The UK Treasury (basically the government's finance department) is now exploring replacing stamp duty altogether, at least for people selling their main residence. The new idea? A proportional property tax.

Rather than buyers paying a big lump sum tax when they move, this new tax would apply to homeowners selling properties worth more than £500,000.

Key points:

• Only affects owner-occupied homes (not second homes, for now)

• Tax is paid by the seller, not the buyer

• Based on the value of the property, not fixed bands

• Government would collect it via HMRC

• Council tax changes may follow later

The aim? To make the system fairer, simplify moving home, and reflect modern house prices.

🔍 Why This Matters to You

Right now, stamp duty affects around 60% of UK home purchases. Under the new model, that could drop to just 20%, mostly homes over £500,000.

That’s great news for many first-time buyers or families upsizing, especially in areas like the Midlands, North West, or Scotland where property prices are lower than in London or the South East.

But for sellers of more expensive homes, this could mean a new tax bill that didn’t exist before.

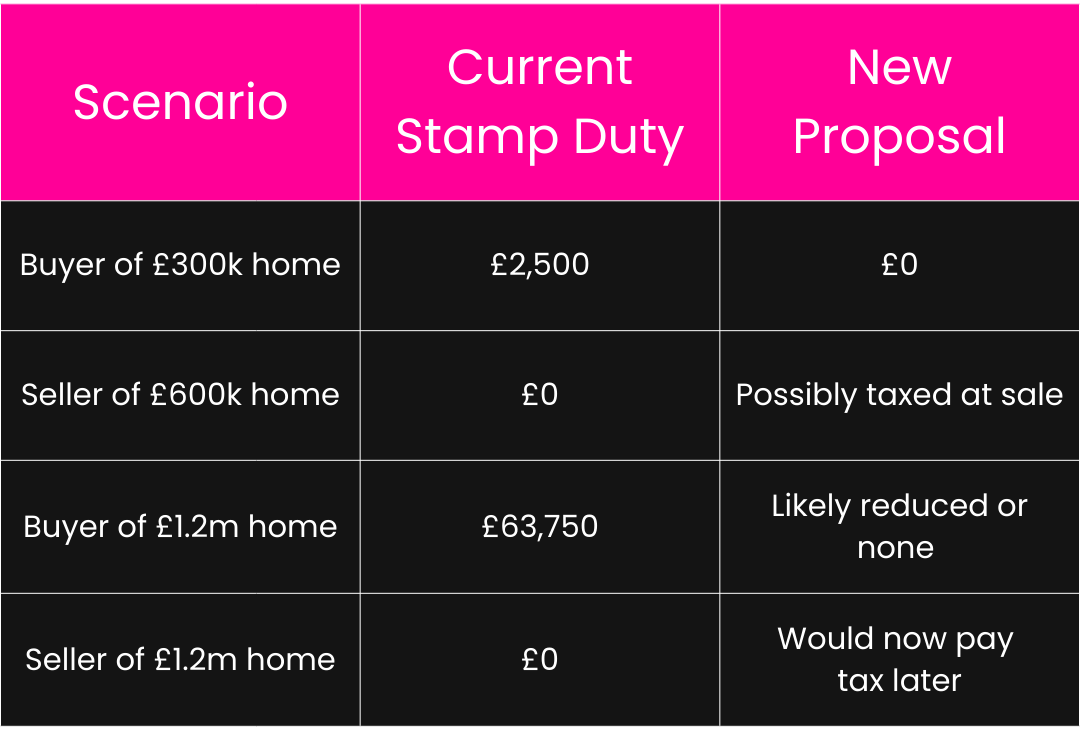

Let’s break that down:

🏛 What About Council Tax?

This isn’t just about stamp duty. The government is also looking at replacing council tax in the long run again, making it more aligned with current property values.

Did you know? Council tax bands were last updated in 1991. That means someone in a London flat could be paying less than someone in a larger but cheaper house in the North.

A proposed local property tax could:

• Replace outdated council tax bands

• Be paid annually by owners, not just residents

• Start from £800/year and scale with the home’s value

• Fund local councils more fairly

But this change is likely further down the road, maybe not until the next Parliament.

⚖️ Why This Might Be Good (or Bad) News

✅ Pros:

• Makes moving house more affordable for buyers

• Reflects current market values (finally!)

• Encourages mobility: good for jobs, families, and lifestyle

• More stable income for local councils

❌ Cons:

• Sellers of high-value homes could face big new tax bills

• May complicate the sales process

• Could impact the high-end market if not phased in carefully

🥑 avocado property’s Take

This could be one of the biggest shake-ups in UK property taxes in decades. And if it goes ahead, it will reshape how people buy and sell homes, from first-time buyers to downsizers.

At avocado property, we welcome any change that makes the market fairer, simpler, and more accessible. But we also know it’s easy to feel lost in the detail.

That’s where we come in.

Our self-employed estate agents guide clients through every stage—from understanding taxes to negotiating the sale. We do more than list your home, we fight for the best outcome for you.

📣 Stay In the Know

Tax changes like this can take time but we’ll keep you updated every step of the way. If you’re thinking about moving or just want to talk strategy, let’s chat.

👉 Reach out today and book a free property consultation with your local avocado agent.