The UK Property Market Update for the week, finishing Sunday, the 16th March 2025

As we move through March, there’s plenty to keep an eye on in the UK property market. Whether you're thinking about selling, buying, or just like to stay informed, here's a breakdown of how the market performed over the past week.

UK Property Market Update – Week Ending Sunday 16th March 2025

As we move through March, there’s plenty to keep an eye on in the UK property market. Whether you're thinking about selling, buying, or just like to stay informed, here's a breakdown of how the market performed over the past week.

✅ New Listings – Properties Coming to Market

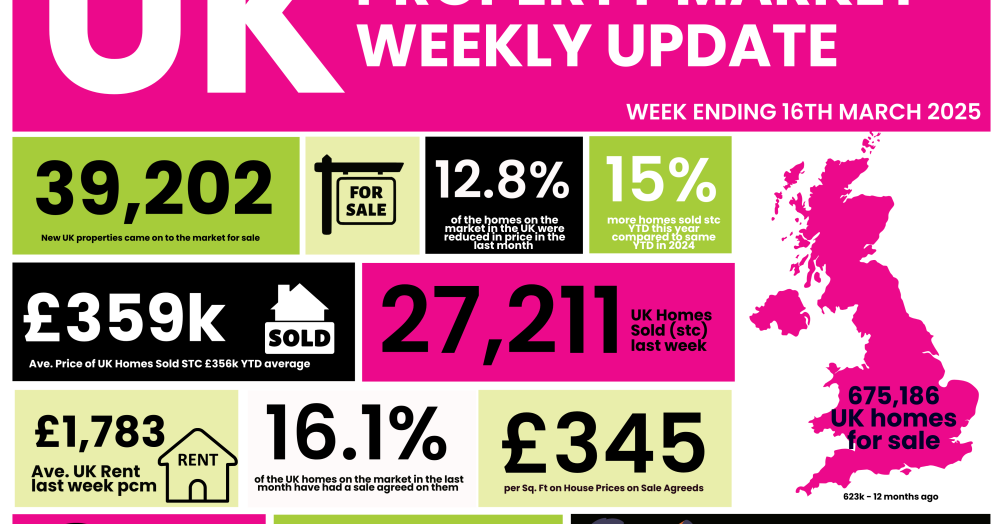

This week saw 39,200 new homes listed across the UK – slightly down from 39,800 last week.

Compared to the same period last year, that’s a 7% increase. When compared with the average for this time of year across 2017, 2018, and 2019, we’re seeing a 10% uplift, showing increased seller confidence in the market.

✅ Price Reductions – Sellers Adjusting to Market Conditions

There were 24,000 price reductions recorded this week, which equates to around 1 in every 8 homes for sale (or 12%) seeing a price adjustment.

That’s consistent with the 2024 average of 12.1%, but still above the longer-term 5-year average of 10.6%, suggesting some sellers are responding to a more price-sensitive buyer pool.

✅ Gross Sales – Sales Agreed This Week

This week saw 27,200 homes sold subject to contract, up from 26,700 last week.

This marks a 15% rise compared to the same point in 2024, and a 25% increase on the YTD average for 2017–2019 – a strong indicator of ongoing buyer demand.

✅ Sale-Through Rate – How Much Stock is Selling

Looking at February’s figures (the most recent monthly data), 16.2% of residential stock went under offer.

That’s just below the 16.7% recorded in February 2024, but still higher than the 2024 monthly average of 15.3%. The 8-year average sits at 17.9%, so while slightly down, the pace remains steady.

✅ Fall-Throughs – Sales That Didn’t Complete

There were 6,319 sales that fell through last week, from a total sales pipeline of 451,074 properties.

This means 22.3% of this week’s agreed sales didn’t proceed, down from 24.3% the week before. It’s slightly below the 7-year average of 24.2%, and well under the spike of 40%+ seen after the Truss Budget in Autumn 2022.

For the whole of February 2025, 5.48% of agreed sales in estate agents’ pipelines fell through – on par with the 2024 average of 5.36%.

✅ Net Sales – Gross Sales Minus Fall-Throughs

After accounting for fall-throughs, there were 20,900 net sales this week, up from 20,200 last week.

The 2025 weekly average currently sits at 19,700, and year-to-date net sales are 12% higher than in 2024, and 18% higher than the same period in 2017–2019.

What Does This Mean for You?

Whether you’re thinking of selling or just keeping an eye on the market, these figures show encouraging signs. More homes are coming to market, buyers are active, and net sales are on the rise.

If you'd like to talk about what this means for your property plans in Solihull or the surrounding areas, we’d love to help.

📞 07538 298 911

📧 clint@avocadopropertyagents.co.uk