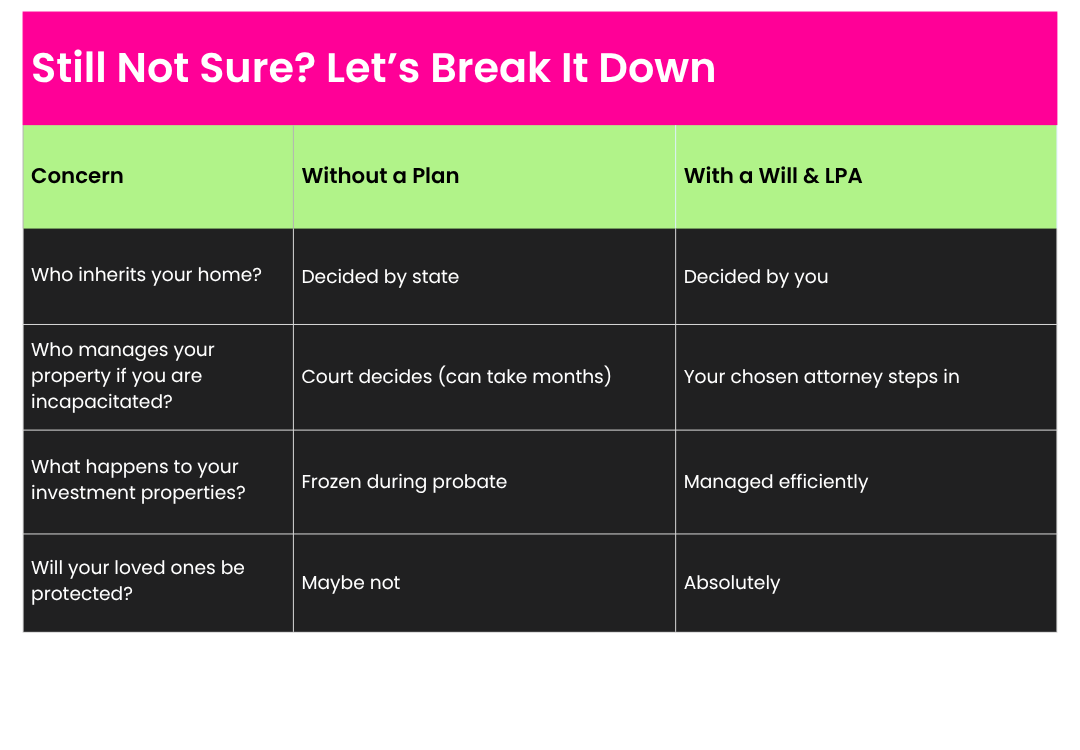

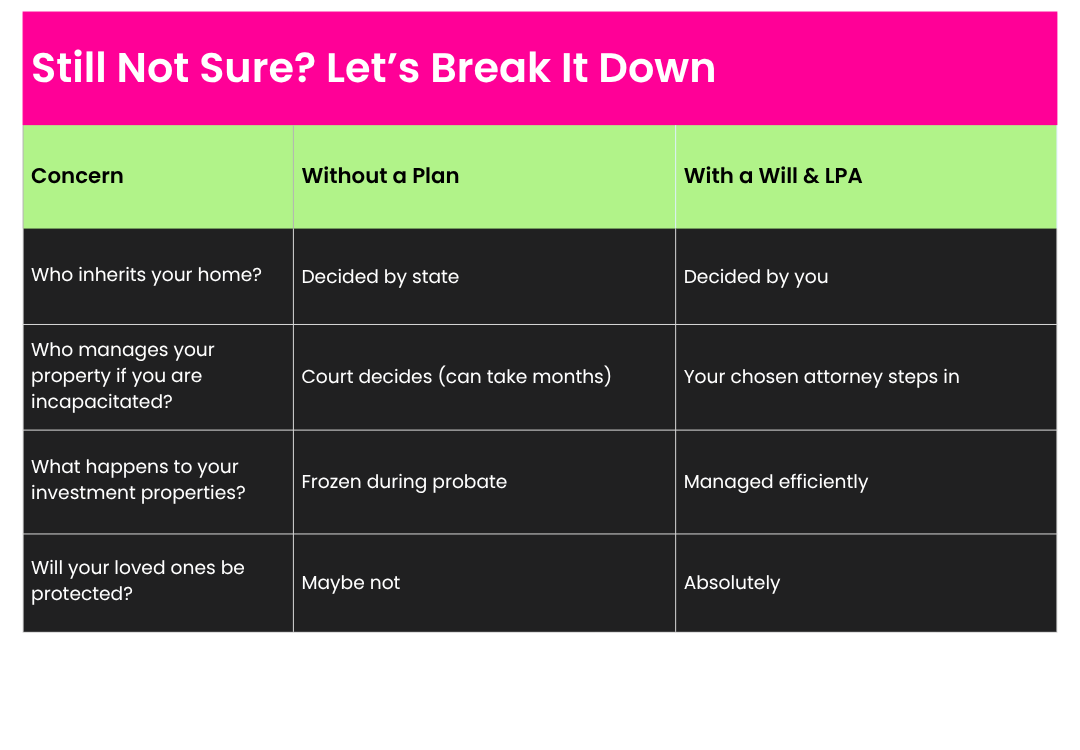

Whether you bought your home five months ago or five years ago, the truth is the same: your property is one of your most valuable assets, and without a proper plan, it may not go where you’d want if something happens to you.

A Will and Lasting Powers of Attorney (LPA) make sure your home, savings, and investments are handled exactly as you intend — protecting both your family and your property.

What Happens If You Don’t Have a Will?

In the UK, dying without a valid Will means your estate is distributed under intestacy laws — not your wishes. That could mean:

- Your partner may not inherit your home unless you’re married or in a civil partnership.

- Your children could face costly and lengthy legal delays.

- If you own with someone else as “tenants in common,” your share may not pass to them.

- Investment properties could be frozen during probate, disrupting income or leaving them unmanaged.

Why Lasting Powers of Attorney (LPAs) Matter

Estate planning isn’t just about what happens after death. If illness or accident leaves you unable to make decisions, no one automatically has the right to:

- Manage your mortgage or bills.

- Access your bank accounts.

- Make property or healthcare decisions.

An LPA gives a trusted person legal authority to step in — quickly and without expensive court intervention.

Why We Recommend Soteria Planning

At Avocado Property, we’ve seen the stress families face when these protections aren’t in place. That’s why we’ve partnered with

Soteria Planning, who offer:

- Clear, jargon-free guidance.

- Tailored advice for both homeowners and property investors.

- Affordable, professional support in setting up Wills, LPAs, and wider estate planning.

Next Step

If you own property in the UK, estate planning isn’t optional, it’s essential.

Drop the Soteria Planning team a message today to get your Estate Planning journey underway.

Next Step

Next Step