If you’re a homeowner in Henley thinking about selling, brace yourself for a bit of uncomfortable truth.

There is a growing gap in our town between what Henley home sellers want and what buyers are actually willing to pay. And the evidence for this is laid out, month after month, in cold, hard numbers.

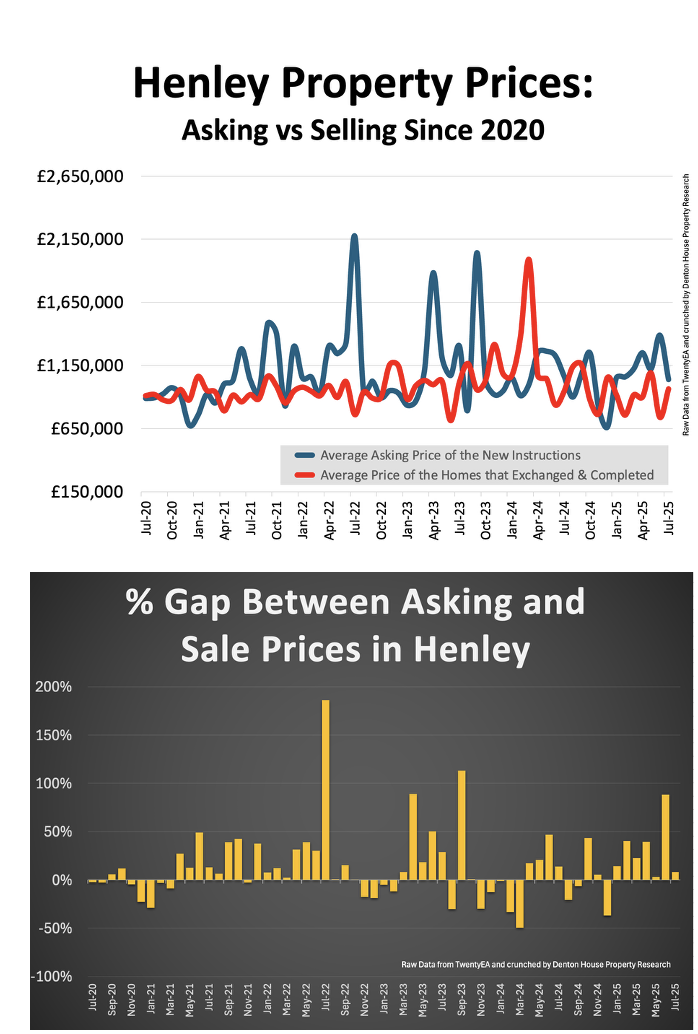

Since the summer of 2020, we’ve been tracking two key numbers: the average asking price of homes coming to market in Henley, and the average sale price of homes that exchanged and completed. The results are striking and eye-opening.

In 2025 so far, the average asking price of the homes coming onto the market in Henley has been £1,149,100. But the average price of a Henley home that’s actually sold and completed is £897,600. That’s a 28.0% difference.

And no, this isn’t about a property crash or Henley sellers taking a 20% or more hit on their asking prices. This is about what sells versus what sits on the market.

It’s Not That Henley House Prices Are Falling. It’s That High-Priced Henley Homes Don’t Sell as Well

Let’s be very clear. This 28.0% gap doesn’t mean house prices have dropped by 28.0%. It simply shows that Henley homes at the higher end of the market are much less likely to sell. They get listed, they linger, and they often withdraw unsold. Meanwhile, lower-priced Henley homes tend to fly off the shelf.

It’s a classic case of saleability versus ambition.

In 2020, the gap between the average asking price and average sale price in Henley was -2.5% (£880,100 asking vs £902,400 selling).

By 2021, it was 15.1%. Rose to 20.1% in 2022,was 15.2% in 2023, -6.1% in 2024, and now we’re at 28% in 2025.

(Henley is RG9).

So, what’s going on?

Higher Price Brackets in Henley Have Lower Odds of Selling

It’s a simple truth: the higher up the price range you go, the harder it is to get a deal done.

That doesn’t mean the more expensive Henley homes won’t sell. But it does mean your pricing and presentation must be spot on for it to sell.

Wishful thinking won’t cut it.

The average asking price of property that has come on the market in Henley in the last five years has been £1,080,200.

· For all the Henley homes that have come onto the market below £1,080,200 in the last 5 years, they have had a 47.5% chance of selling and homeowners moving.

· For all the Henley homes that have come onto the market above £1,080,200 in the last 5 years, they have had a 41.8% chance of selling and homeowners moving.

Realistic Pricing Matters

Here’s another stat Henley home sellers need to understand.

Homes that agree a sale within 25 days of coming onto the market have a 94% chance of subsequently exchanging contracts and completing (i.e. the homeowner moves). Yet, for homes that sit for 100 days or more before a sale is agreed, the odds of the homeowner moving drop to just 56%.

In other words, if you get the price right from day one, you are far more likely to secure a solid buyer and sail through to completion. But if your home languishes on the portals for months, you are not only likely to have to reduce, if you do indeed manage to agree a sale on it, your odds are only slightly better than a flip of a coin.

What This Means for Henley Homeowners

If you’re thinking of putting your home on the market this year, here’s the uncomfortable but helpful advice:

- Don’t just look at what homes are being listed for. Look at what's selling — and selling within a month or two.

- Be honest about your timeframe. If you want to move soon, pricing realistically from day one will give you a better shot.

- Higher-value homes must work harder. Presentation, photography, pricing, and agent skill all matter more than ever when your Henley home sits in the upper price bands.

The Bottom Line for Henley Homeowners

Many homes listed in Henley this year won’t sell.

Not because they are bad homes. Not because the market is broken. But because many sellers and yes, some estate agents, are still pricing for the market they wish they had, rather than the market we do have.

If your Henley home is priced at the top of its range, you must demand an agent who can justify every pound, back it up with real buyer insights, and be honest with you from the start.

Otherwise, you risk becoming part of the Henley homeowners that don’t sell, as opposed to the Henley homeowners that move to the next chapter of their life.