Average house price exceeds £250,000

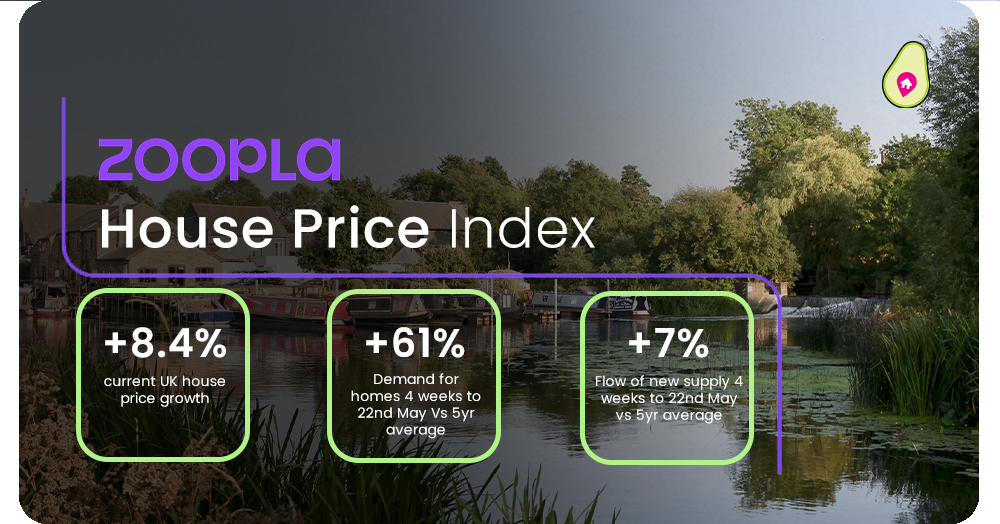

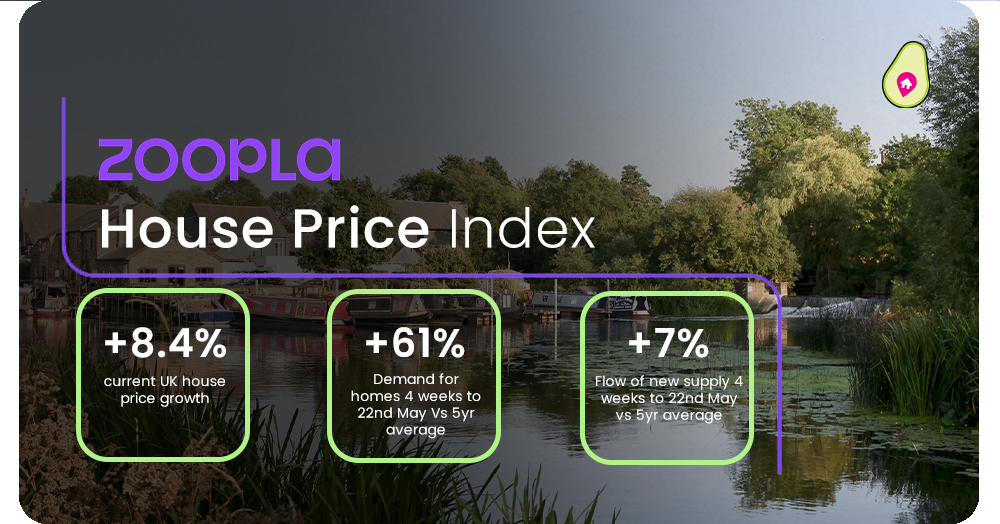

The price of an average UK home rose by £456 in April, taking the average value to £250,200 – another record high. The annual rate of growth in house prices is now at 8.4%, although this is down from 9% in March and April.

The quarterly rate of growth has slowed to +1.3%, from +2% in January, while the monthly change of +0.2% is down from +0.7% at the start of the year.

As ever, the annual rate of house price growth is not even across the country. For the 15th consecutive month, Wales leads the way, with 11.6% annual growth in house prices. However, this marks a decline from the 13% price growth registered in February. Average house prices are up 10.5% on the year in the South West, and 10.2% in the East Midlands.

Bringing up the rear in terms of price growth is London, with 3.6% growth on the year. In terms of major cities, Nottingham has moved into pole position in terms of price growth, at 10%, followed by Liverpool at 9.9% and Bournemouth at 9.7%. For the smaller cities, Warrington is out in front, with 12.9% growth, Wigan close behind with 12.2% and Rochdale has registered 11.6% growth.

These growth rates underline the trends that have emerged strongly since the pandemic - some of the most affordable housing markets have seen the biggest price growth as there is more room for values to rise.

Time to sell lengthening

Time to sell lengthening There are several signs that the housing market may be starting to ease after a period of intense activity, leading to upwards pressure on prices. The conditions in the market, led by the pandemic-driven ‘reassessment of home’, with owners reviewing where and how they are living, has created high levels of demand –and a very fast-moving market (as well as price increases).

The average time taken to secure a sale – measured in days between listing a property and sale agreed, fell to very low levels early this year. But the average time to sell is now starting to rise, as shown in the chart above. There is an element of seasonality in these figures, as we move on from the busy Spring market. But the data also signals that the demand pressure in the market is easing as the economic headwinds – rising inflation and cost of living, starts to have an effect among buyers. The market is still busy and there are still high levels of buyer demand, but a quick comparison year on year shows a softening in demand for family homes outside London.

Asking price reductions

The proportion of listings where asking prices have been reduced is rising. Looking only at reductions of more than 5%, to ascertain which listings have registered a meaningful price reduction, shows that one in twenty listings (5.1%) have been re-priced in the last month. This is up from 4.7% in April.

The average price reduction is 9%, which, when applied to the average property price, equates to a reduction of around £22,500.

This indicates that even in a market with high levels of buyer demand, where plenty of sales are being agreed based off the original asking price, there is resistance from buyers around pricing in some instances, which will start to slow the level of price growth. Given the increase in house prices and mortgage rates, affordability considerations for buyers will be front of mind. The average mortgage payment for an average-priced property has risen by £71 a month or £852 a year since the start of the pandemic. The average income needed to secure a mortgage on an £250,000 property, based on 4.5 x income has also risen by £4,500 over the same period.

Outlook

House price growth at 8.4% means that the average house price in the UK has risen above £250,000 for the first time. But behind the headline figures, there are signs emerging that the market is softening, which will put the brakes on price growth during the rest of the year.

High levels of buyer demand mean that the market is still moving quickly, but the time to sell - the time taken between listing a property and agreeing a sale – is starting to rise across most property types in most locations. (The exception is flats in London, a market which is seeing its own ‘mini-bounce back’ after a drop in demand during the pandemic).

There is likely an element of seasonality in the rise, but we do expect that the time to sell measure will continue to rise over the summer and into H2 as buyer demand levels start to fall, punctured by changing sentiment around the cost of living and personal finances.

The data indicates that at present, while the increased economic headwinds are already affecting sentiment at the more economic end of the housing market, those with more disposable income are still driving activity. But this group will also be influenced by the cloudier outlook during the rest of the year.

Another signal that the market is starting to soften is the number of properties where asking prices are being cut. One in twenty properties listed on Zoopla has been re-priced by at least 5% this month, with the average new asking price some 9% below the original. This signals increased buyer resistance to higher prices, and indicates that even amid high levels of demand, price growth may be hitting a natural ceiling.

Given the number of homeowners on fixed-rate mortgages, which protect them against interest rate rises in the short to medium-term, the stress tests carried out on those loans, and the healthy employment market, we are not expecting a raft of forced sales in 2022, which is usually the trigger for price falls.

But we do expect the rate of price growth to ease – on a monthly basis price growth has already moderated. A continuation of this trend, with some monthly declines, will mean annual price growth will reach +3% by year end.

If you had any questions about any of the topics in this blog then get in contact with us on the details below 👇

Or if you would like to find out how much your property is worth then click the link below 🏠