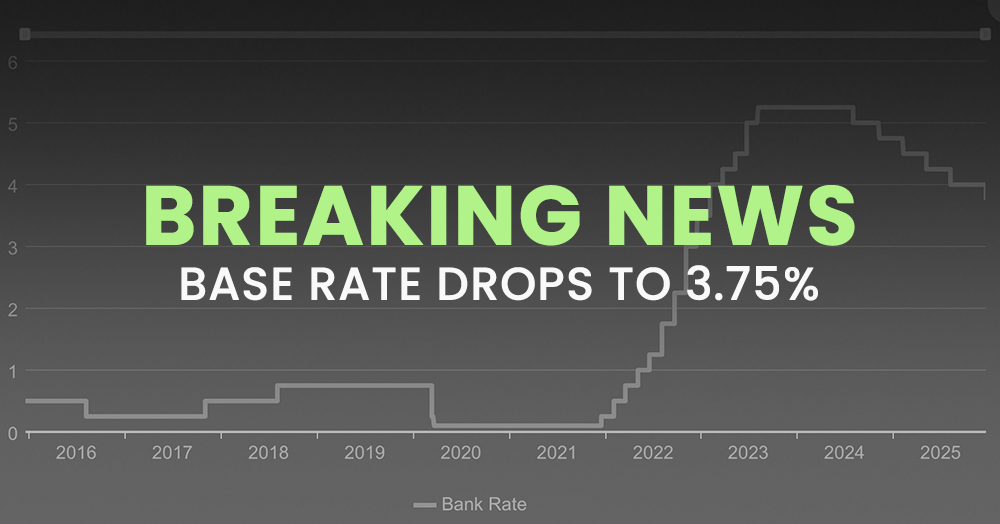

Breaking News: Bank of England Drops Base Rate To 3.75%

The Bank of England has cut the base rate from 4.00% to 3.75% as inflation eases and economic growth slows. For homeowners and buyers, this could mean lower mortgage repayments, more affordable borrowing, and a shifting property market making now a key time to understand what this change means for you.

Thinking of moving in 2026? Here’s what the latest rate cut could mean for you.

The Bank of England has cut the UK base interest rate from 4% to 3.75%, following signs that inflation is easing and economic growth has softened. This comes after the previous cut in August 2025, when the rate dropped from 4.25% to 4.00%. For homeowners, buyers, and savers, this change could make a real difference in the months ahead.

What This Means for Mortgages

If you’re on a tracker or variable-rate mortgage, this reduction should help lower your monthly repayments as lenders adjust their rates. Thinking about remortgaging or moving home soon? This could make borrowing a little more affordable. Fixed-rate deals have already been trending lower in anticipation of this cut, especially shorter-term fixes, which are now more competitive.

If you’re unsure what deal is right for you, speak to our friends at Mortgage Tribe to explore your options and get tailored advice on finding the best mortgage for your situation.

What This Means for Savings

Lower interest rates often lead to lower savings returns. If you rely on easy-access or variable accounts, you might see your returns soften over the coming weeks. If you’re saving for a deposit or a property top-up, it’s worth checking your accounts to make sure you’re getting the best rates.

The Broader Picture

With inflation easing to around 3.2% and unemployment nudging higher, the Bank’s decision is all about balancing lower borrowing costs with ongoing inflation pressures. Analysts expect rates may continue to drift downwards gradually in 2026, depending on how the economy performs.

Thinking About Moving in 2026?

Don’t wait to find out what your home could be worth. Our local avocado partner agents are ready to provide a free, no-obligation valuation and guide you through your next steps with confidence. Whether you’re planning a move, curious about your options, or just want a clear picture of the market, we’re here to help every step of the way.

📞 Book your free valuation today and take the first step towards your next move.