Mortgage Matters: Local Insights for Ruislip & Pinner

Wondering how the latest mortgage trends could affect you and your property? In this month’s Mortgage Minute, we break down the key updates, local insights, and tips to make the most of the current market in Ruislip and Pinner. Whether you're buying, selling, or just curious, it’s a must-read for staying one step ahead!

This month's mortgage news comes from Richard Campo at Heron Financial

In yet another very busy month we have seen even more lending products available, in fact, to record levels. Inflation is down, which keeps the door open to more rate cuts this year and I even managed to find some good news in the Spring Statement! So for all that and a recap on money markets, hope you enjoy this update:

Mortgage Market Update

Spring Statement

While there wasn't much good news from the Chancellor in Spring Statement, the thing that really stood out from a Mortgage and Property perspective was the very clear drive to 'Get Britain Building'. In fact, aside from a big increase in the Military budget this is starting to look like the cornerstone of the Govt's growth plans and as well it should! I have been saying for years this is an open goal that has been consistently missed. We have a shortage of homes, and a shortage of skilled trades people to build them, it shouldn't take a genius to work a plan to relax the planning rules and encourage more apprenticeship schemes, so credit to Labour for finally getting on with this.

The Office for Budget Responsibility (OBR) forecasts also support this drive. They believe that with Labours plans Housebuilding will get to a 40 year high under this parliament and boost the economy by £6.8bn. Their forecast believes we will see 1.3m new homes by 2030, just shy of the Govt own target of 1.5m, so things are very much heading in the right direction. That alone won't deal with the more structural problems of the UK economy, but it is positive news in our world and long overdue.

Inflation Falls

There was more encouraging news in the lower than expected reading on inflation. It fell to 2.8% from 3% in the year to February. This has boosted the odds of a rate cut in the Bank of England’s meeting on the 8th May (financial markets currently predict a 55% chance of a cut) with a further cut expected before the end of the year. As the Bank of England typically moves rates at 0.25% at a time, if all goes to plan, we should end the year with the base rate at 4% (down from the current level of 4.5%)

There is no getting away from the current environment which is very volatile, and hence why financial markets are making such tentative bets, but so far, the direction of travel for rates looks positive as it means the current batch of very low rates around the 4% mark will be here to stay for the foreseeable future. We have even seen a few 3.99% rates available in recent weeks, so as ever, if you are in a position to secure your next year, we would urge you to do so ASAP as this can all change quickly at the moment!

Product Choice Increases further

Last month we reported that the data firm MoneyFacts had seen both Buy To Let and Small Deposit mortgages hit record levels. This month, Twenty7Tec (the mortgage sourcing platform) says that total product choice has hit an all-time high of 25,090 in February, which was a 2.33% increase on products available since January but significantly a 27.1% increase on the same month last year!

This increases competition is leading lenders to cut prices as mentioned above and it is great to see more product choice and whole new lenders enter the market. This is always a win for consumers as greater competition drives down costs and opens up more options. We have said this a few times now, but if you couldn't quite do what you wanted to do last year, worth engaging with us again as you may be pleasantly surprised about what new options are available.

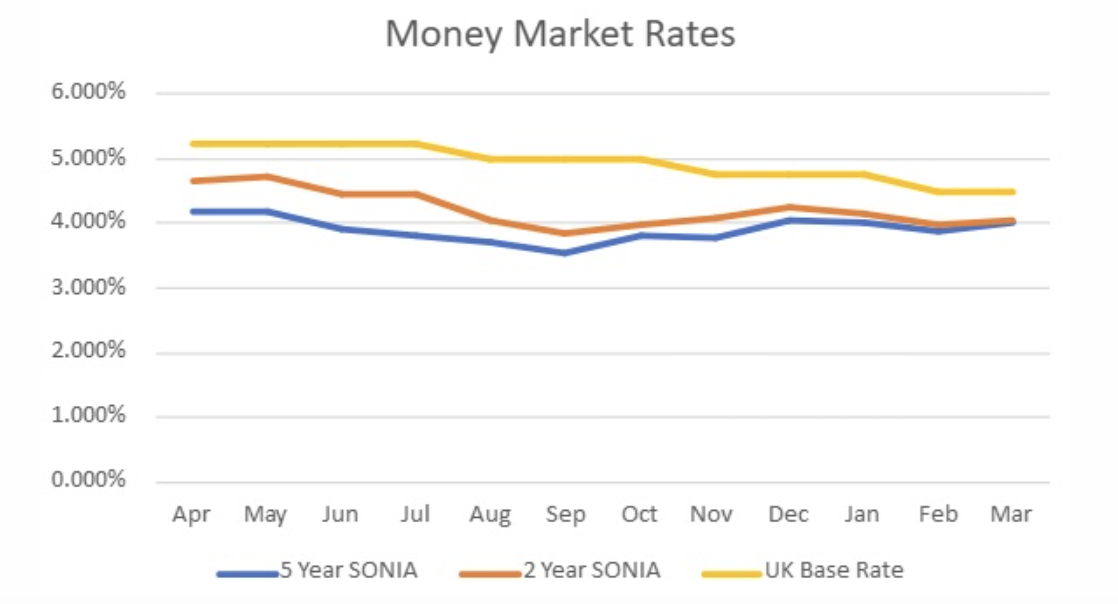

Money Market & Mortgage Rates

Money Market Rates as of 28/03/25

5 Year money Up to 4.032%

2 Year money Up to 4.041%

UK Base Rate held at 4.50%

Source: chathamfinancial.com & Bank of England

Summary

Now more than ever, quality financial advice is needed. Not just to navigate the product options discussed above, but also the very tricky 'affordability' rules that lenders are imposing. This is how lenders determine how much they will lend you, which sways hugely on your income, outgoings, debts, commitments and spending patterns. Not all lenders look at things the same way, so that is why it is imperative you talk to an adviser who can find the best way forward for you.

If you would like to speak with me personally on anything property related please do get in touch for some free honest advice:

James Burgess

07513137021

james@avocadopropertyagents.co.uk