Barclays is cutting mortgage rates from 9 July 2025, with standout deals for first-time buyers, home movers, landlords, and large-loan borrowers. Highlights include sub‑4% rates on high-value and buy-to-let loans, plus big reductions at 85% LTV for remortgages. A clear signal: the mortgage market is turning more borrower-friendly.

Barclays has announced significant cuts to its mortgage rates, effective 9 July 2025. These changes benefit first-time buyers, home movers, large-loan borrowers, and buy‑to‑let landlords—particularly those with strong LTV positions.

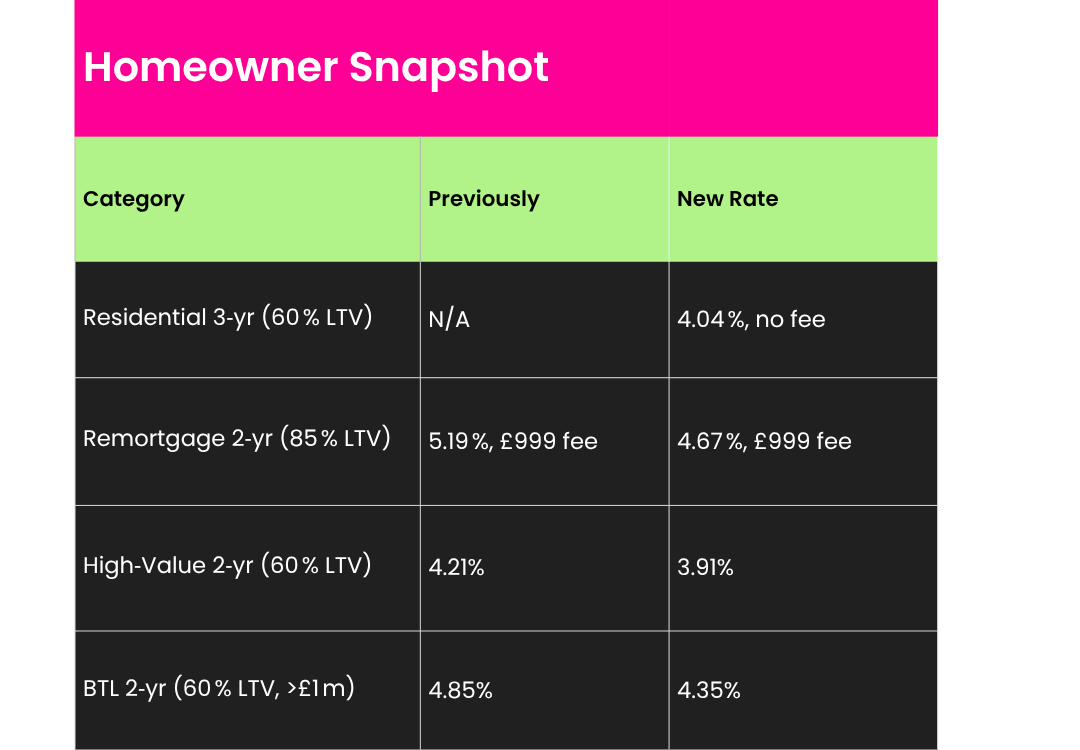

Key Residential Rate Changes

- New three-year fixed purchase deals:

- 4.04 % at 60 % LTV, no product fee (mpamag.com)

- 4.09 % at 75 % LTV, £899 fee

- Remortgages:

- Two‑year fixed at 85 % LTV cut from 5.19 % to 4.67 %, £999 fee

- Five‑year fixed at 85 % LTV down from 4.97 % to 4.52 %

- Large loans (above £2 million):

- Two‑year fixed at 60 % LTV reduced to 3.91 %;

- Five‑year fixed now 3.99 %, both new low points (The Intermediary)

Buy‑to‑Let (BTL) Now More Competitive

- Two‑year fixed for loans over £1 million at 60 % LTV cut from 4.85 % to 4.35 %

- Five‑year equivalent reduced from 4.65 % to 4.15 %

- Reward‑range BTL offers also saw reductions up to 0.6 percentage points across various LTV bands

Why It Matters for Avocado Property Clients

1. First‑time buyers & home movers: These lower rates mean more affordable fixed-term borrowing options, making home ownership even more accessible.

2. Remortgaging opportunity: Anyone approaching the end of a fixed-term deal at higher rates should explore Barclays’ revised offers, especially at 85 % LTV.

3. High‑value borrowers: Investment properties and portfolios benefit from standout low rates under 4% for 2- and 5‑year terms.

4. Landlords & green investors: BTL rate cuts and energy‑efficient product adjustments help both ecological goals and profitability.

Market Context & Strategy Tips

Barclays’ moves come amid intense competition rivals like HSBC, Santander, Halifax, Nationwide, and TSB have also reduced their mortgage rates recently.

Meanwhile, the UK base rate has been lowered to 4.25 % in early May, with expectations of further reductions before the year’s end .

Final Thoughts

Barclays’ substantial rate reductions (especially those dipping below 4%) signal a shift toward a more borrower-friendly market.

With further cuts potentially on the horizon, now’s a smart time to review your options.

If you’re thinking about buying, remortgaging, or investing, feel free to

get in touch with us or speak directly to our trusted mortgage advisors at

Mortgage Tribe for tailored advice.